BBA Customs and International Trade

May 11, 2023 2024-07-24 7:26Fall & Spring

Intake

Full & Part Time

Study Mode

123 hours

Total Credit Hours

4 Years

Duration

English

Language

Overview

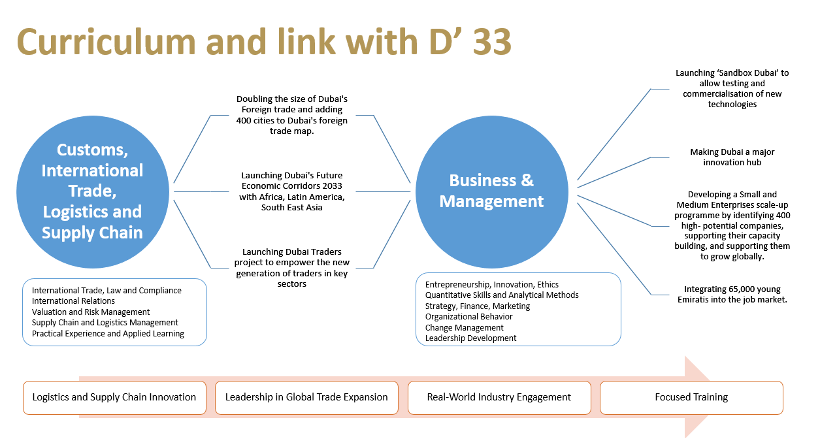

This program aims to meet the immediate workforce requirements of our strategic partners, fosters a skilled talent pool that supports the broader D33 objectives of economic growth and international trade expansion. By ensuring that the educational offerings are closely aligned with industry needs and standards, the University of Dubai continues to contribute significantly to the region’s competitiveness on a global scale.

This program aims to meet the immediate workforce requirements of our strategic partners, fosters a skilled talent pool that supports the broader D33 objectives of economic growth and international trade expansion. By ensuring that the educational offerings are closely aligned with industry needs and standards, the University of Dubai continues to contribute significantly to the region’s competitiveness on a global scale. Admission Requirement

| High School | English | Math |

| 75% for General Stream 70% for Advanced or Elite Stream | EmSAT 1100 or Academic IELTS 5.00 or TOEFL (PBT 500 or IBT 61 or CBT 173) | EmSAT 600 or UD math placement test |

Who is the program for?

- Aspiring Trade and Customs Professionals: Individuals who aim to build a career in customs, international trade, supply chain management, or logistics and want to acquire specialized knowledge and skills.

- Current Industry Professionals: Those already working in customs, trade, supply chain, or logistics who wish to advance their careers, gain a deeper understanding of industry practices, and stay updated with the latest regulations and technologies.

- Recent High School Graduates: Students who have completed their high school education and are looking to pursue a bachelor’s degree that offers promising career opportunities in the international trade and customs sectors.

- Career Changers: Professionals from other fields who are looking to switch careers and enter the dynamic and growing field of customs and international trade.

- Entrepreneurs and Business Owners: Individuals who own or plan to start businesses that engage in international trade and require comprehensive knowledge of customs regulations, trade laws, and supply chain management.

- Government and Regulatory Body Employees: Employees of government agencies or regulatory bodies who need specialized training in customs and international trade to enhance their understanding and performance in their roles.

- International Students: Students from around the world who wish to study in a globally connected and economically vibrant city like Dubai, gaining insights into international trade practices that can be applied in various countries.

- Strategic Partners and Industry Stakeholders: Employees from organizations that are strategic partners with the program’s educational institution, who require up-to-date training and education to meet immediate workforce needs.

Career Opportunities

- Customs Officer: Responsible for enforcing customs laws and regulations, processing imports and exports, and preventing illegal trade activities.

- International Trade Specialist: Manages and coordinates international trade transactions, ensuring compliance with trade laws and regulations.

- Supply Chain Manager: Oversees the entire supply chain process, from procurement to delivery, ensuring efficient and cost-effective operations.

- Logistics Coordinator: Manages the logistics and transportation of goods, ensuring timely and efficient delivery while maintaining quality standards.

- Compliance Officer: Ensures that the organization adheres to all customs, trade, and regulatory requirements, mitigating risks and avoiding legal issues.

- Freight Forwarder: Coordinates the shipment of goods, arranging transportation, handling documentation, and ensuring that goods reach their destination on time.

- Import/Export Manager: Manages the import and export processes, including documentation, compliance, and logistics, to facilitate smooth international trade operations.

- Trade Analyst: Analyzes trade data, market trends, and regulatory changes to provide insights and recommendations for optimizing trade strategies.

- Warehouse Manager: Oversees warehouse operations, including inventory management, order fulfillment, and logistics coordination.

- Customs Broker: Assists clients in clearing goods through customs by preparing and submitting required documentation, calculating duties and taxes, and ensuring compliance with regulations.

- Logistics Consultant: Provides expert advice to organizations on improving their logistics and supply chain processes, enhancing efficiency, and reducing costs.

- Procurement Manager: Manages the procurement process, sourcing goods and services, negotiating contracts, and ensuring timely and cost-effective acquisition.

- Operations Manager: Oversees day-to-day operations within the supply chain and logistics sectors, ensuring that all processes run smoothly and efficiently.

Estimated salary range

- Customs Officer:

- Entry-Level: AED 130,000 – AED 180,000 per year

- Experienced: AED 180,000 – AED 260,000 per year

- International Trade Specialist:

- Entry-Level: AED 150,000 – AED 200,000 per year

- Experienced: AED 220,000 – AED 310,000 per year

- Supply Chain Manager:

- Entry-Level: AED 200,000 – AED 260,000 per year

- Experienced: AED 300,000 – AED 400,000 per year

- Logistics Coordinator:

- Entry-Level: AED 150,000 – AED 200,000 per year

- Experienced: AED 220,000 – AED 270,000 per year

- Compliance Officer:

- Entry-Level: AED 160,000 – AED 220,000 per year

- Experienced: AED 240,000 – AED 330,000 per year

- Freight Forwarder:

- Entry-Level: AED 150,000 – AED 200,000 per year

- Experienced: AED 220,000 – AED 290,000 per year

- Import/Export Manager:

- Entry-Level: AED 180,000 – AED 240,000 per year

- Experienced: AED 260,000 – AED 350,000 per year

- Trade Analyst:

- Entry-Level: AED 160,000 – AED 220,000 per year

- Experienced: AED 240,000 – AED 310,000 per year

- Warehouse Manager:

- Entry-Level: AED 160,000 – AED 220,000 per year

- Experienced: AED 240,000 – AED 310,000 per year

- Customs Broker:

- Entry-Level: AED 150,000 – AED 200,000 per year

- Experienced: AED 220,000 – AED 290,000 per year

- Logistics Consultant:

- Entry-Level: AED 180,000 – AED 240,000 per year

- Experienced: AED 260,000 – AED 370,000 per year

- Procurement Manager:

- Entry-Level: AED 200,000 – AED 260,000 per year

- Experienced: AED 300,000 – AED 400,000 per year

- Operations Manager:

- Entry-Level: AED 200,000 – AED 260,000 per year

- Experienced: AED 300,000 – AED 400,000 per year

Study Plan

| Semester (1) 18CH | Semester (2) 15CH | |||||||||

| Code | Course Name | Pre-requisite | CH | Code | Course Name | Pre-requisite | CH | |||

| BCIT110 | Introduction to WTO Agreements, Interpretation andApplication | None | 3 | BCIT120 | Overview of WCO Instruments and Their Functions | BCIT110 | 3 | |||

| ESPU 200 | English for Special Purposes | None | 3 | GITB 120 | Introduction to Information Technology | None | 3 | |||

| GMAT 110 | Mathematics for Business I | None | 3 | GCMM 205 | Communication & Negotiations Skills | ESPU 200 | 3 | |||

| GEST 100 | Emirati Studies | None | 3 | BBUS 110 | Fundamentals of Innovation & Entrepreneurship | ESPU 201 | 3 | |||

| GISL 100/105 | Islamic Thought (English or Arabic) | None | 3 | BSTA 200 | Statistical Analysis | GMAT 110 | 3 | |||

| GCRT 200 | Critical and Creative Thinking | None | 3 | |||||||

| Semester (3) 15CH | Semester (4) 15CH | |||||||||

| Code | Course Name | Pre-requisite | CH | Code | Course Name | Pre-requisite | CH | |||

| BCIT 230 | Fundamentals of Economics | None | 3 | BCIT 240 | International Economics | BCIT 230 | 3 | |||

| BBUS 225 | Research Methods | BSTA 200 | 3 | BBUS 205 | Quantitative Analyses in Business | BSTA 200 | 3 | |||

| BBUS 305 | Business Law | ESPU 200 | 3 | BMPO 310 | Change Management | BMNG 200 | 3 | |||

| BCIT 231 | International Agreements on Trade and Customs | None | 3 | BCIT 241 | International Trade Terms and Documentation | None | 3 | |||

| BMNG 200 | Management & Organizational Behavior | ESPU 200 | 3 | BMNG 315 | International Business Management | None | 3 | |||

| Semester (5) 15CH | Semester (6) 15CH | |||||||||

| Code | Course Name | Pre-requisite | CH | Code | Course Name | Pre-requisite | CH | |||

| BFIN 200 | Principles of Financial Management | None | 3 | BLOM 301 | Logistics and Supply Chain Operations Management | BMNG 310 | 3 | |||

| BMRK 200 | Principles of Marketing | BCIT 230 | 3 | BCIT 360 | Global Trade Compliance | None | 3 | |||

| BCIT 350 | Custom Valuation and Procedures | None | 3 | BBUS 200 | Introduction to Responsible Business | None | 3 | |||

| BMNG 310 | Operations Management | BBUS 205 | 3 | BCIT 361 | Trade Analytics | None | 3 | |||

| BMPO 322 | Human Resources Management | BMNG 200 | 3 | BMPO 320 | Leadership Development | BMNG 200 | 3 | |||

| Semester (7) 18CH | Semester (8) 12CH | |||||||||

| Code | Course Name | Pre-requisite | CH | Code | Course Name | Pre-requisite | CH | |||

| BBUS 400 | Strategic Management (Capstone) | 90 CH | 3 | BCIT 480 | Cross Border Anti Money Laundering | None | 3 | |||

| BCIT 470 | Technology, Border Security and Inspection | None | 3 | BCIT 481 | Risk Management in International Trade and Customs | None | 3 | |||

| BCIT 471 | International Economic Relations and Diplomacy | None | 3 | BCIT 482 | International /National Customs/ Port Visit | 105 CH | 3 | |||

| BLOM 305 | Purchasing and Supply Management | BBUS 205 | 3 | BBUS 343 | Emerging Technologies in Business | GITB 120 | 3 | |||

| BCIT 472 | Industry project - BBA – CA | 93CH | 6 | |||||||

Course Descriptions

- Required Business Courses (45 Credit Hours)

BBUS 200 Introduction to Business Administration

This course provides students with an introduction to the fundamental principles of Business Administration. It examines the factors that lead towards successful administration of a business, and the achievement of organizational goals. The course covers topics such as Accounting, Finance, Marketing, Leadership, Entrepreneurship, Social Responsibility and Ethics, International Business, and MIS. Prerequisite: None.

BECN 100 Microeconomics

The purpose of this course is to familiarize students with the essential microeconomics tools to 1) study how consumers and businesses make decisions in the face of resource scarcity, 2) examine how their interactions in the market determines prices and quantities of goods, and 3) assess the efficiency of markets in the presence of government influence and under different market structures. It is hoped that as a result of taking this course, students will develop an appreciation of the economic way of thinking about real-world problems and develop interest in pursuing a career in economics. Prerequisite: GMAT110: Mathematics for Business I.

BECN 225 Macroeconomics

This course provides an overview of determination of output; unemployment; interest rates, and inflation. Monetary and fiscal policies are discussed besides public debt and international economic issues. The course introduces basic models of macroeconomics and illustrates principles with the experience of the UAE and other economies. It also exposes students to the Islamic economics whenever applicable. Prerequisite: BECN 100 Microeconomics.

BSTA 200 Statistical Analysis

The purpose of the course is to acquaint students with the basic concepts of statistics and probabilities that will help them make decisions. Coverage includes: basic probability, sampling, hypothesis testing, simple and multiple regression models. Prerequisite: GMAT110: Mathematics for Business I.

BBUS 225 Research Methods

The purpose of this course is to enable students acquire the skills necessary to develop scientific research proposal. It will enable the students undertake systematic research using empirical and non-empirical approaches, conduct literature review and structure and manage a research project on UAE firms. Prerequisite: BSTA 200: Statistical Analysis.

BACC 205 Principles of Financial Accounting

The course introduces students to accounting concepts, principles, and processes underlying the production of financial statements, and also analyzes measurement and reporting of business transactions to users of financial statements. Prerequisite: None

BBUS 205 Quantitative Analyses in Business

This course is considered as an introduction to recent developments in quantitative techniques with particular emphasis on management applications. Techniques include linear programming, descriptive statistics, probability, expectations, games and decisions, testing of hypotheses, analysis of variance, and operations research. Suitable software will be used to help solve the problems. Prerequisite: BSTA 200 Statistical Analysis.

BFIN 200 Principles of Financial Management

The purpose of this course is to help student an understanding management of finance within a business organization. The coverage includes the sources of finance, the basic financial techniques such as TVM technique used for making decisions in relation to valuation of financial instruments, risk and return trade off. Prerequisite: BACC 205 Principles of Financial Accounting.

BMNG 200 Management & Organization Behavior

This course gives students a critical understanding of essential management functions such planning, organizing, leading/interpersonal influence, and managing in both local and international contexts. The course develops a management framework based on diverse corporate culture before broadening that environment to a global level. This course examines individual and group behavior in companies in depth. It teaches students how to manage businesses more successfully while also improving the quality of the work environment for employees. Motivation, individual and group behavior, employee diversity, attitude and job satisfaction, leadership, communication channels, group dynamics, job design, conflict, and power and politics are among the topics covered. Students should get a grasp of managerial responsibilities and the essential skills and have the necessary abilities to apply them in real-world circumstances.

BMRK 200 Principles of Marketing

The purpose of this course is to introduce students to the marketing process, global market place and consumers, integrated marketing communication and marketing plan. Prerequisite: None

BBUS 305 Business Law

This course focuses on business law within the context of contract and civil law. Topics include legal forms of business organization & ownership, contract & sales law, government regulation of business, laws relating to business, bankruptcy, finance, banking, and insurance. Prerequisite: ENGL 105 English II.

BMNG 310 Operations Management

Operations management is an area of business concerned with the production of goods and services in a wide range of contemporary contexts. It involves the study of concepts, theories and techniques relating to the operations functions in both manufacturing and service organizations. The course will cover classical topics in operations management including forecasting, inventory management, capacity planning, location planning, quality management, waiting lines, supply chain management. Case studies are used to provide a comprehensive knowledge of the theories, current practices, and trends. Prerequisite: BBUS 205: Quantitative Analyses in Business.

BMNG 315 International Business Management

This course aims at introducing students to the various practices, environments, and functions involved in the field of international business. It includes analysis of the environmental factors (such as culture, communication, behavior) at the international, national and industry levels. The course addresses the functional areas of business (Marketing, Finance, Production, and Human resources), and assesses, in this respect, the global competitiveness of the UAE/ economy. Prerequisite: BBUS 100 Introduction to Business Administration.

BBUS 400 Strategic Management

The purpose of this course is to stimulate and develop students’ awareness and understanding of the key concepts of Strategic Management. The coverage includes situational analysis, the generation of choices of alternate actions and issues of implementation of the chosen course of action. Prerequisite: 90CH.

BBUS 343 Emerging Technologies in Business

The course focuses on introduction to emerging technologies and its application in the business context, both in public and private sectors. Emerging technologies such as Big-Data, Artificial Intelligence (AI), Block-Chain, Robotic Process Automation, Internet of things (IoT), and leverage these technologies to improve business management and performance.

- Majors Courses (30 Credit Hours)

BCA 200 – Customs Theory and Practice

This course introduces the students to whole spectrum of Customs administration theory, policy and law. It focuses on the use of the modern customs management methods which leverage information and other contemporary technologies, risk management, in the execution of various customs procedures and processes. Prerequisites: None.

BCA 210 – Harmonized System, Classification and Customs Tariff

This course covers in detail the classification methodology of coding, describing and classifying goods under Harmonized Commodity Description and Coding System which is developed and maintained by the World Customs Organization. It imparts practical classification and interpretation skills to the students. Prerequisites: None.

BCA 300 – International Agreements on Trade and Customs

This course covers the development key International Agreements on Trade and Customs. It explains the obligations, rights and privileges of the parties to various Trade and Customs Agreements. And it gives a comprehensive review of the role played of Customs in the day-to-day implementation of those Agreements. Prerequisites: BCUS 200 – Customs Theory and Practice.

BCA 310 – Customs Valuation

This course teaches the students to WTO Valuation Agreement and imparts knowledge and skills of using the six Customs Valuation Methods. It also handles the implementation aspects of these methods in the UAE and GCC context. Prerequisites: None.

BCA 320 – Post-Clearance Audit

Post-clearance Audit (PCA) is a type of customs control that has many benefits such as revenue protection, improvement traders’ compliance, detection, and prevention of fraud, increasing the efficiency of customs control, etc. The course helps learners to achieve comprehensive knowledge of organizing, managing, and performing Post-Clearance Audit in any Customs organization. Also, extra emphasis is put on inculcating PCA skills within the context of the United Arab Emirates and other GCC Countries. Prerequisites: None.

BCA 400 – Customs Procedures and Trade Facilitation

This course deals with learning the best approaches and practices to implement the various customs procedures efficiently so as to achieve the governments objectives. It also focuses on effective trade facilitation and border management. Thus it makes ample use of the principles and standards enshrined in the Revised Kyoto Convention and the WTO’s Trade Facilitation Agreement. Prerequisites: BCUS 200 – Customs Theory and Practice.

BCA 410 – Risk Management and Customs Intelligence

This course emphasizes the use of Risk Management to achieve various customs objectives (such as safety & security and trade facilitation) in an efficient manner. It covers Risk Management Techniques and Strategies in a Customs context. It also elaborates the role Customs Intelligence and highlights WCO initiatives in developing and sharing Intelligence. Prerequisites: None.

BCA 420 – Technology, Border Security and Inspection

The course covers the use of technology in border security and inspection. It addresses the theoretical, legal and managerial elements that are necessary for effective use of technologies. The course also has a practical part whereby students have the opportunity to use SIMFOX scanning/inspection simulations. Students are also trained in using Virtue Reality (VR) technology in customs inspection. Prerequisites: None.

BCA 440 – Customs Investigation and Law Enforcement

This course covers investigative procedures and processes. It teaches how to make best use international tools like the WCO Customs Enforcement Network to achieve success on national/regional levels. It also elaborates the basics investigation such as “first officer responsibilities”, “crime scene protection”, interviewing witnesses, and interrogating suspects to obtain confessions, etc. Prerequisites: None.

BCA 473 – Industry Project

The purpose of this course is to provide the working student an opportunity to develop competence in applying learned theories and gained skills to an actual business problem or issue. A student will undertake a supervised project to tackle an existing business problem or an available opportunity for improvement at his organization, explore possible causes of the problem, alternative solutions, and assess the effect(s) of each solution on the organization. Alternatively, a student may develop and document a business case dealing with an actual business problem that the organization managed to identify and solve it. Each student will present orally the result of his project in addition to a written report. Prerequisites: the completion of 90 CH.

Apply Now

Apply Now